Analysts Warn That CoreWeave Stock Is ‘High Risk,’ But They Still Want You to Buy CRWV Now

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

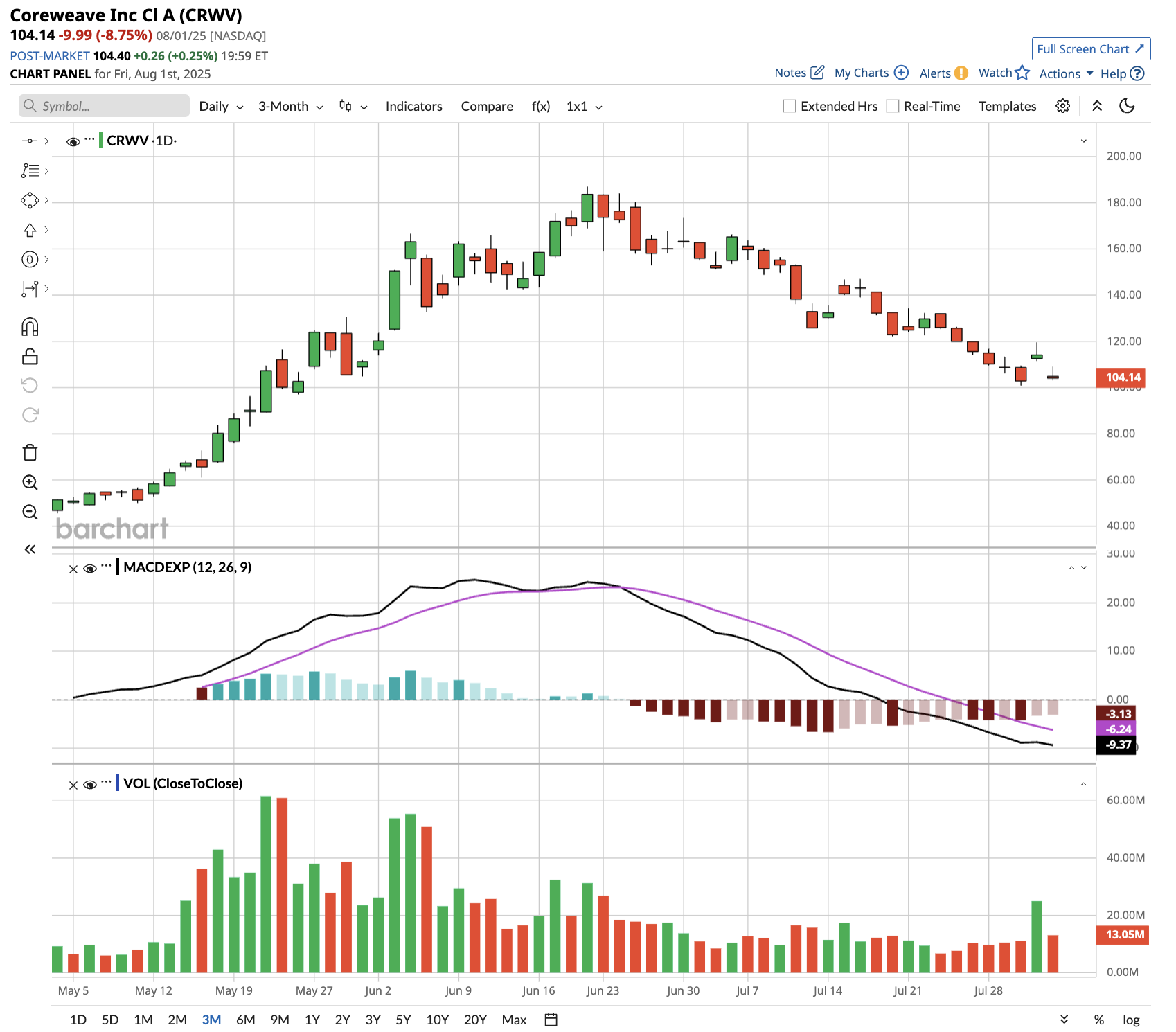

CoreWeave (CRWV) just earned an analyst upgrade from a brokerage firm that tags that stock as “High Risk,” reflecting Wall Street's conflicted stance on the volatile cloud-computing company that has surged 160% since its IPO earlier this year - and already fallen 44% from its June highs.

Specifically, Citi analyst Tyler Radke last Thursday upgraded CoreWeave from "Hold" to "Buy," while keeping a $160 price target, citing accelerating AI capital expenditures from major tech companies. Microsoft's (MSFT) massive spending plans should benefit CoreWeave in particular, as the tech giant represents the company's largest customer and recently announced plans to spend $30 billion in Q3, 60% above analyst expectations.

Meta (META) and Microsoft's latest earnings showed no signs of AI spending deceleration, with Meta's capex nearly doubling year-over-year while Microsoft's grew 22% to $17.1 billion. This sustained investment creates continued demand for CoreWeave's GPU-as-a-Service offerings, with Radke acknowledging that the results from Microsoft mean that Citi is “incrementally more confident about the durability of AI demand and CRWV’s position in the market.”

CoreWeave's business model requires enormous capital investments to build and operate AI infrastructure, raising questions about long-term profitability. The AI infrastructure company continues burning cash while expanding capacity, with Wall Street expecting a $0.23 per share loss on $1.08 billion revenue for Q2.

Moreover, as tech giants expand their internal AI capabilities, they may eventually reduce reliance on third-party providers like CoreWeave. This threat to CoreWeave’s competitive moat concerns some analysts, who question whether current demand justifies the elevated valuation.

Behind the CoreWeave-Core Scientific Tie-Up

CoreWeave recently announced a transformative $9 billion all-stock acquisition of Core Scientific (CORZ), positioning the AI infrastructure provider for unprecedented scale in the rapidly expanding artificial intelligence market.

The Core Scientific acquisition would transform CoreWeave from an infrastructure tenant to an owner, providing control over 2.3 gigawatts of power capacity across nine sites. The deal eliminates over $10 billion in future lease obligations while generating expected annual cost savings of $500 million by 2027. More importantly, the acquisition provides access to infrastructure-specific financing mechanisms that should significantly reduce CoreWeave's cost of capital.

Core Scientific's cryptocurrency mining assets offer additional optionality, with 500 megawatts available for conversion to AI workloads or potential divestiture based on strategic priorities.

CoreWeave Raised Guidance Ahead of August Earnings

In Q1 of 2025, CoreWeave grew revenue by 420% year over year to $982 million while adjusted operating income surged by 550% to $163 million. Revenue backlog reached $25.9 billion, supplemented by an additional $4 billion expansion contract signed in Q2, bringing total committed revenue to nearly $30 billion. The standout performance was driven by accelerated infrastructure deployment and strong customer demand across both training and inference workloads.

Management raised full-year revenue guidance to $4.9-5.1 billion while increasing capital expenditure expectations to $20-23 billion, reflecting accelerated customer demand. CoreWeave expects to more than double its deployed power capacity by year-end, demonstrating the massive infrastructure scaling required to meet AI workload demands.

CoreWeave's vertically integrated approach, combining purpose-built software with owned infrastructure, positions it to capture significant value as AI adoption accelerates across enterprise markets.

CEO Mike Intrator highlighted CoreWeave’s successful transition toward inference revenue, which represents actual AI monetization rather than just model development. This shift demonstrates that CoreWeave's customers are moving from research to revenue-generating applications, validating the long-term sustainability of AI infrastructure demand.

What's Next for CoreWeave Stock?

Quarterly earnings are due out from CRWV after the close on Tuesday, Aug. 12, with the consensus looking for an adjusted per-share loss of $0.20 and revenue of $1.08 billion. In its Q1 results, the company reported a wider-than-forecast loss, while revenue topped estimates. Currently, the options market is pricing in a 16% earnings reaction for CRWV stock.

Analysts tracking CRWV stock estimate revenue to increase from $5 billion in 2025 to $28.4 billion in 2029. While CoreWeave is forecast to report an adjusted loss of $1.21 per share, its earnings might improve to $3.61 per share in 2028.

Given its stellar growth estimates, the tech stock might command a lofty price-to-earnings multiple in the future. If CoreWeave stock is priced at 60x forward earnings, it should trade around $215 in early 2028, indicating an upside potential of over 100% from current levels, for investors willing to hold over the long haul.

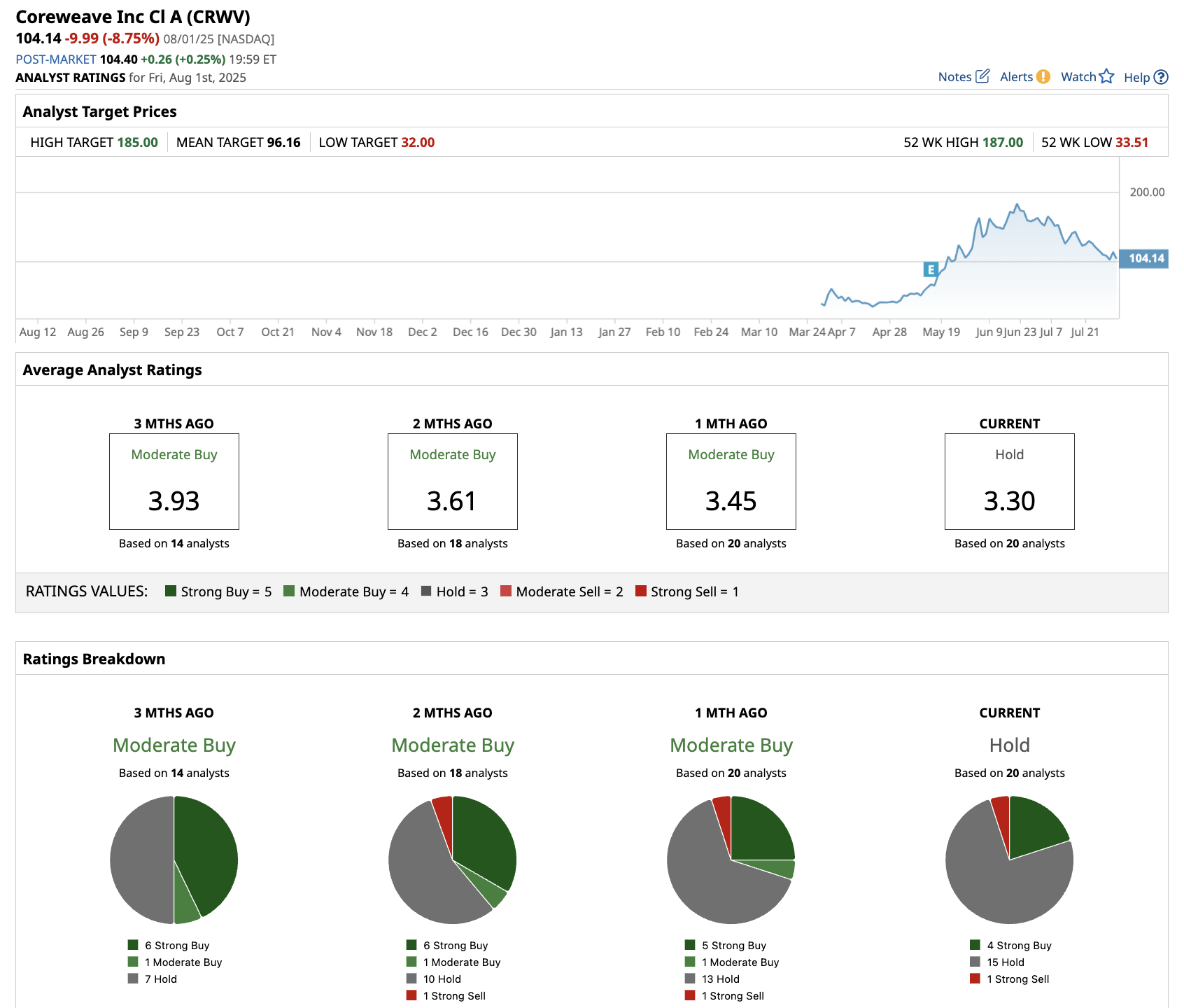

As of right now, though, the consensus rating among the 20 analysts tracking CRWV stock has dropped to a “Hold,” down from “Moderate Buy” one month ago. The average CoreWeave stock price target is $96.16, a discount to Friday's closing price at $104.14.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.