Is SoFi Stock a Buy Before its Q2 Earnings on July 29?

SoFi (SOFI), a leading financial technology company, is gearing up to announce its second-quarter earnings for 2025 on Tuesday, July 29. The market has been highly optimistic about SoFi, with its stock growing by an impressive 99% in the last three months. Moreover, SoFi stock has gained 179% over the past year. These substantial gains reflect the company’s consistently strong financial performances over the past several quarters, strategic efforts to diversify revenue streams, and effective management of credit risks.

The significant appreciation in SoFi stock has raised valuation concerns ahead of earnings. Notably, the upcoming Q2 earnings report will determine whether SoFi can sustain its upward trajectory.

SoFi to Deliver Solid Growth in Q2

After a strong start to 2025, where the company added 800,000 new members and 1.2 million new products in Q1 alone, SoFi’s second-quarter outlook looks promising. The momentum from the first quarter is expected to carry into Q2 as it will continue to benefit from user growth, expanding product offerings, and a strategic shift toward more capital-efficient revenue streams.

Management has guided for adjusted net revenue between $785 million and $805 million, representing a 31% to 34% increase compared to the same quarter last year.

Another key driver of SoFi’s Q2 financials could once again be its strategic shift away from capital-intensive lending and toward fee-based, non-lending businesses. These businesses, which include its Technology Platform and Loan Platform Business (LPB), now account for a growing share of revenue and offer higher margins with lower risk exposure. In Q1, non-lending revenue surged to $407 million, a 66% jump from the year prior. Fee-based revenue rose 67% to a record $315 million, reflecting that these segments are emerging as SoFi’s key growth catalysts.

One of the standout performers has been SoFi’s LPB segment. This business line, which originates loans on behalf of third parties, has scaled rapidly, reaching a $6 billion annualized run rate in originations in less than a year. In Q1 alone, LPB contributed $96 million in adjusted net revenue, up 44% from the previous quarter. Crucially, these loans carry no credit risk for SoFi, enhancing customer relationships and opening the door to further cross-selling opportunities. Its recent agreements to strengthen and diversify its funding capabilities and sources are expected to accelerate growth in this segment.

At the same time, SoFi’s Technology Platform remains a steady contributor. Despite some account churn due to client diversification, the platform reported $103 million in Q1 revenue, representing 10% year-over-year growth. Management is optimistic that new client wins will offset these losses and drive renewed growth through 2026.

Lending, the company’s original core business, also remains strong. Q1 adjusted net revenue from lending came in at $412 million, a 27% year-over-year increase with a healthy 58% contribution margin. Loan originations hit a record $7.2 billion, up 66% from a year ago. Personal loans made up the lion’s share at $5.5 billion, including $1.6 billion from LPB’s third-party activity. Student and home loan originations also posted impressive gains, rising 59% and 54%, respectively.

While SoFi’s top line will likely sustain the momentum, its deposits have climbed to $27.3 billion, providing a stable and cost-effective funding base. This growth in deposits is expected to reduce SoFi’s annual funding costs, which should support future earnings.

Looking ahead to Q2, SoFi expects to deliver adjusted net income between $60 million and $70 million, with adjusted earnings per share (EPS) in the range of $0.05 to $0.06. Analysts are currently forecasting EPS of $0.06. The company has outperformed Wall Street’s estimates for four consecutive quarters and delivered a 100% earnings surprise in the first quarter.

Is SoFi Stock a Buy at Current Levels?

SoFi’s growth across all key segments, the rise of capital-light businesses, and a strengthening deposit base create a compelling long-term story. SoFi’s ability to adapt and execute has positioned it well to deliver continued outperformance, especially as it transitions to a more balanced and diversified business model.

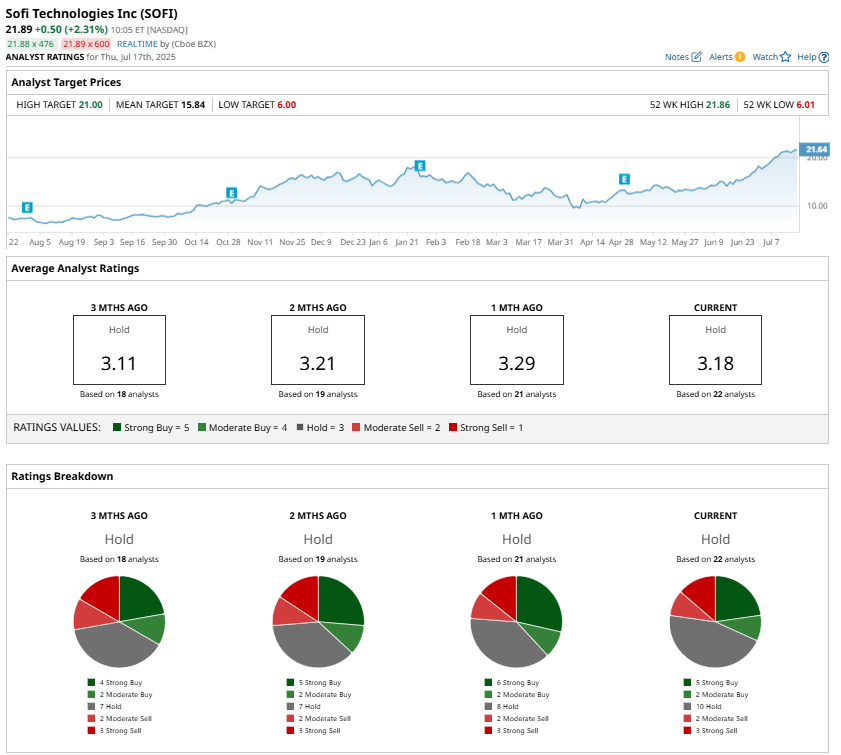

However, after such a steep rally, valuation is becoming harder to ignore. Despite the strong growth outlook, analysts remain cautious and maintain a “Hold” consensus rating. This implies that now may be a time to wait, as Q2 could determine the future trajectory of the stock.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.